maryland ev tax credit 2021 update

As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax credit for both plug-in electric vehicles and fuel cell vehicles for Fiscal. The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the.

Electric car buyers can receive a federal tax credit worth 2500 to 7500.

. For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle Credit. Tax credits depend on the size of the vehicle and the capacity of its battery. Maryland EV is an electric vehicle education and outreach resource serving Maryland and the Mid-Atlantic.

Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle. Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Electric Vehicle EV and Fuel Cell. Learn more about the incentives and rebates on EVs and Home Charging Stations in Maryland below. The total amount of funding currently available for this rebate program in state fiscal year FY 2022 7122- 63023 is up to 1800000.

Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles. Organized by the Maryland Department of Transportation. You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Maryland Excise Tax Creditup to a maximum of 3000 for Electric. The credit is for 10 of the cost of the qualified vehicle up to 2500.

Effective July 1 2023. Top content on Electric Maryland and Tax Credit as selected by the EV Driven community. List of Maryland EV Tax Credit Opportunities.

Maryland HB44 2021 Extending and altering for fiscal years 2021 through 2023 the Electric Vehicle Recharging Equipment Rebate Program for the purchase of certain electric vehicles.

Get A Tax Credit For Buying An Electric Vehicle Updated List 2023

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Annual Enacted Ev Policies More Than Double Between 2015 And 2020 Atlas Ev Hub

How Do The Ev Tax Credits In The Inflation Reduction Act Work

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

Electric Vehicles Pepco An Exelon Company

In Maryland Harris Unveils Plan For Electric Vehicle Charging Network Maryland Daily Record

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Energy Administration

Ev State Incentive Programs Rexel Energy Solutions

Will Europe Retaliate For Congress S Proposed Electric Vehicle Tax Credits Don T Bet Against It The Hill

Maryland Solar Incentives Md Solar Tax Credit Sunrun

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Volkswagen

Tax Update Maryland Electric Vehicle Tax Credits Are Back Travis Raml Cpa Associates Llc

2022 Ev Tax Credits In Maryland Pohanka Automotive Group

Ev State Incentive Programs Rexel Energy Solutions

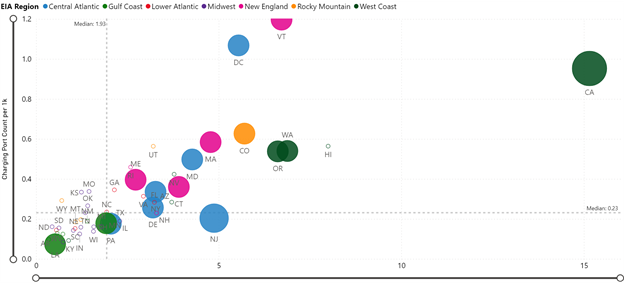

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

.jpg)